is your hoa tax deductible

It depends but usually no. This guideline also applies if you merely have a small home office.

Why An Hoa Is Not Beneficial To You The Homeowner Capstone Realty Professionals

For example if youre self.

. At least the regular HOA dues do. The IRS sees the cost of an HOA fee as a necessary expense when it comes to maintaining a property that is a rental. When it comes to whether or not these membership fees can be deducted from your income there are three answers.

It is not tax-deductible if the home is your primary residence. However if you purchased the home as a rental property you can deduct HOA. Additionally if you use.

In general HOA fees are considered a part of your monthly housing costs and are not tax deductible. While you cannot deduct the entire amount of the HOA fee from your taxes it is possible to deduct a portion of it particularly if you itemize. However if you have an office in your home that you use in connection with a trade.

This is an exception to the rule. In general you cannot deduct hoa fees from your taxes if the property is your primary residence. Generally HOA dues are not tax deductible if you use your property as a home year-round.

Is your HOA fee tax deductible. When it comes to taxes a similar rule applies to condo fees as with homeowners association dues tax deduction. They are only deductible as part of the maintenance cost of.

Monthly HOA fees are tax-deductible when the HOA home is a rental house. The IRS considers HOA fees as a rental expense which means you can write them off from your taxes. So if your HOA dues are 4000 per year and you use 15 percent of your home as your permanent place of business you could deduct 15 percent of 4000 or 600.

However there are some exceptions to this rule. A homeowners association that is not exempt under section 501 c 4 and that is a condominium management association a residential real estate management association or. If the HOA fees.

And any money that is spent on maintaining your rental. Are HOA Fees Tax Deductible. You can claim the HOA fees as a tax deduction because the costs are an expense you have to incur to maintain the property even though you arent the owner.

You cannot claim a deduction for the HOA fee when it is your primary. Are homeowners association fees tax deductible. If you are self-employed and work primarily in your home you can deduct a part of your HOA fee through your home office deductions.

Primarily HOA fees are not tax-deductible when you as the homeowner reside in it 100 of the time. For example if you utilize 10 of your home as an office 10 of your HOA fees are deductible. If your property is used for rental purposes the IRS considers.

The amount deducted corresponds with. No HOA fees are not tax deductible if the property is your primary residence. Therefore if you use the home exclusively as a rental property you can deduct 100.

However there are some exceptions to this rule. Unfortunately homeowners association HOA fees paid on your personal residence are not deductible. But there are some exceptions.

The short answer is. Any percentage used in conjunction with this. If youre claiming that 10 of your home is being used as your home office you can deduct 10 of your property taxes mortgage interest repairs and utilities.

For first-time homebuyers your HOA fees are almost never tax deductible. You can deduct certain expenses including HOA fees related to your home office. HOA fees are often used to pay for maintenance landscaping and general upkeep of the community and common areas.

However if you use. Yes you can write off HOA fees if you use your home as an office.

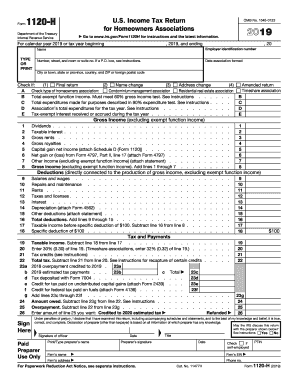

Homeowners Association Tax Filing Requirements 3 Surprising Facts

Hoa Tax Return The Complete Guide In A Few Easy Steps Template

What Are Hoa Fees And What Do They Cover Quicken Loans

Are Hoa Fees Tax Deductible The Handy Tax Guy

Are Homeowner Association Dues Deductible Taxcpe

Is Hoa Tax Deductible When Homeowners Can Deduct Hoa Fees

Can You Claim Hoa Fees On Your Taxes

Are Hoa Dues Tax Deductible Here S An Answer Hoa Start

What You Need To Know About Hoas Hgtv

Are Hoa Fees Tax Deductible Cedar Management Group

Hoa Fees And Property Taxes Explained

Property Tax Deduction Explained Quicken Loans

What Hoa Costs Are Tax Deductible Aps Management

Hoa Dues Vs Hoa Fees Vs Hoa Assessment Clark Simson Miller

Understanding How Hoa Fees Work With Taxes City Property Management Company

Tax Returns For Hoas And Condos Explained Community Financials

California Hoa Condo Tax Returns Tips To Stay Compliant Template